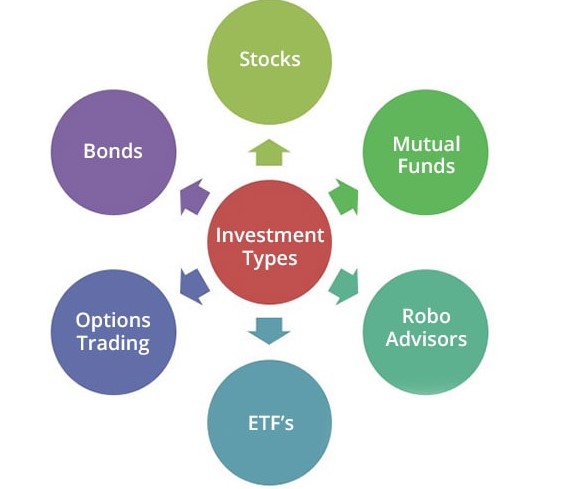

Investing is a crucial aspect of financial planning, offering individuals the opportunity to grow their wealth over time. However, navigating the world of investments can be daunting, especially for beginners. In this guide, we’ll delve into the various types of investments available, exploring their characteristics, risks, and potential returns. Whether you’re looking to build a retirement fund or generate passive income, understanding the different investment options is essential for success.

Stocks: Your Gateway to Ownership

Investing in stocks opens the door to ownership in companies, making it a pivotal avenue for wealth building and financial growth. When you purchase stocks, you essentially become a partial owner of the company, sharing in its successes, profits, and potential growth.

Stocks, also known as equities, are a cornerstone of the financial markets, offering investors a diverse array of opportunities to participate in various industries and sectors. Whether you’re interested in technology, healthcare, finance, or consumer goods, there are stocks available to align with your investment objectives and preferences.

Understanding stocks begins with recognizing the fundamental concept of ownership. When you buy shares of a company’s stock, you acquire a stake in its assets, earnings, and future prospects. This ownership entitles you to certain rights, including voting on corporate matters such as electing board members and approving mergers or acquisitions.

Moreover, stocks offer the potential for capital appreciation and income generation. As the company grows and its profits increase, the value of its stock may rise, allowing investors to sell their shares at a higher price than they initially paid. Additionally, some companies distribute a portion of their earnings to shareholders in the form of dividends, providing investors with a steady stream of income.

Types of investments in stocks can be an empowering and rewarding experience, but it’s essential to approach it with diligence, research, and a long-term perspective. By diversifying your portfolio, conducting thorough analysis of companies and industries, and staying informed about market trends, you can harness the power of stocks to achieve your financial goals and secure your financial future.

Bonds: Fixed-Income Securities

Bonds are vital components of the financial landscape, offering investors a stable source of income and a means to preserve capital. Often referred to as fixed-income securities, bonds represent debt obligations issued by governments, municipalities, or corporations to raise funds for various purposes, such as infrastructure projects, operational expenses, or expansion initiatives.

At its core, types of investments in bonds involves lending money to the bond issuer in exchange for periodic interest payments, known as coupons, and the return of the principal amount at maturity. Unlike stocks, which convey ownership in a company, bonds represent a contractual agreement between the investor and the issuer, with defined terms and obligations.

Bonds come in various forms, each with its own risk-return profile and characteristics. Government bonds, issued by national governments, are generally considered low-risk investments due to the sovereign’s ability to tax and print money to fulfill its debt obligations. These bonds, often referred to as treasuries or sovereign bonds, serve as benchmarks for other fixed-income securities and are prized for their stability and liquidity.

Corporate bonds, on the other hand, are issued by corporations to raise capital for business activities. While corporate bonds offer higher yields than government bonds, they also entail greater credit risk, as the financial health and creditworthiness of the issuing company can impact the bond’s value and ability to meet its obligations.

Municipal bonds, issued by state and local governments, finance public projects such as schools, roads, and utilities. These bonds are typically exempt from federal income tax and, in some cases, state and local taxes, making them attractive options for investors seeking tax-efficient income.

Investing in bonds offers several advantages, including:

- Steady Income: Bonds provide predictable income through regular interest payments, offering stability and cash flow for investors, particularly retirees and income-oriented portfolios.

- Capital Preservation: Bonds are generally less volatile than stocks, making them suitable for investors seeking to preserve capital and mitigate downside risk in their portfolios.

- Diversification: Adding bonds to a portfolio can help spread risk and enhance overall diversification, reducing the correlation between asset classes and improving risk-adjusted returns.

Overall, bonds play a crucial role in investors’ portfolios, offering a balance of income, stability, and diversification. By understanding the different types of bonds available and their respective risks and rewards, investors can construct well-rounded investment strategies tailored to their financial goals and risk tolerance.

Real Estate: Tangible Assets for Long-Term Growth

Real estate stands as a cornerstone types of investments avenue, offering tangible assets with the potential for long-term growth and wealth accumulation. Unlike stocks or bonds, real estate investments involve the ownership, purchase, and management of physical properties such as residential homes, commercial buildings, or land parcels.

Real estate investments provide investors with numerous opportunities to generate income, build equity, and diversify their portfolios. Whether you’re a seasoned investor or a novice looking to enter the market, real estate offers a range of options to suit your investment objectives and risk tolerance.

Residential real estate comprises properties intended for personal occupancy or rental purposes, including single-family homes, condominiums, townhouses, and multifamily residences. Investing in residential properties can yield steady rental income, potential appreciation in property value, and tax advantages such as mortgage interest deductions.

Commercial real estate encompasses properties used for business purposes, such as office buildings, retail spaces, warehouses, and hotels. Commercial real estate investments offer higher rental yields and long-term lease agreements, providing investors with stable cash flow and potential capital appreciation.

Real estate investment trusts (REITs) represent another avenue for investing in real estate without the hassle of property ownership and management. REITs are companies that own, operate, or finance income-generating real estate across various sectors, including residential, commercial, industrial, and healthcare properties. Investing in REITs provides investors with exposure to the real estate market while offering liquidity, diversification, and potential dividend income.

The advantages of investing in real estate are manifold:

- Steady Cash Flow: Rental income from real estate properties can provide investors with a steady stream of cash flow, offering financial stability and passive income.

- Appreciation Potential: Real estate properties have the potential to increase in value over time, driven by factors such as location, demand, and economic trends, allowing investors to build equity and wealth.

- Tax Benefits: Real estate investors can take advantage of various tax deductions, including mortgage interest, property taxes, depreciation, and operating expenses, reducing their overall tax liability and increasing after-tax returns.

Furthermore, real estate types of investments offer tangible assets with intrinsic value, providing investors with a sense of security and stability amid market volatility and economic uncertainty.